Masayoshi Son, the founder, chairman, and CEO of Soft Bank Group, stands as a towering figure in global technology and investment. As of January 2026, Son has reclaimed his position as Japan’s richest person, with a net worth of approximately $58.9 billion according to Forbes’ real-time tracker. His journey from humble beginnings as a Zainichi Korean immigrant’s son to becoming a self-made billionaire exemplifies bold risk-taking, foresight in emerging technologies, and an unwavering belief in the power of information and intelligence. Soft Bank, under his leadership, has evolved from a software distributor into a conglomerate spanning telecommunications, e-commerce, and venture capital, with landmark investments like Alibaba and recent pivots to artificial intelligence (AI) driving his resurgence.

Masayoshi Son story is one of resilience amid discrimination, audacious bets that yielded fortunes (and occasional massive losses), and a philosophical vision for humanity’s future powered by superintelligence. In 2025 alone, Soft Bank’s shares surged over 60%, fueled by AI enthusiasm, propelling Son past rivals like Uniqlo’s Tadashi Yanai. His latest moves—culminating in a historic $41 billion investment in OpenAI and chairing the $500 billion Stargate AI infrastructure project—underscore his transformation of Soft Bank into an AI powerhouse.

Early Life and Education

Born Hiroshima Vasomotor on August 11, 1957, in Toss, Saga Prefecture, Japan, Son grew up in a Zucchini Korean family facing significant societal prejudice. His grandfather, Son Jon-yukking, immigrated from Taegu, Korea, during Japan’s colonial era and worked as a miner. His father, Son Sam-hen, hustled through various ventures—raising pigs and chickens, building an illegal home on railway land, and running a successful bootleg sake business that made the family relatively prosperous, even owning the town’s first car.

Discrimination against Koreans in post-war Japan was rampant; Son endured bullying and once contemplated suicide. Inspired by Den Fujita, McDonald’s Japan founder, who advised him to study English and computers in the U.S., Son dropped out of high school at 16 and moved to Oakland, California. He honed his English at Holy Names College, completed high school in three weeks at Serramonte High, and earned a BA in economics from UC Berkeley in 1980.

During college, Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th Century entrepreneurial spark ignited: he invented an electronic translator sold to Sharp for $1.7 million, imported arcade games for $1.5 million profit, and founded Unison World (sold for $2 million). Returning to Japan in 1981, he adopted his Korean surname “Son” professionally, defying family advice amid lingering anti-Korean sentiment.

This period shaped Son’s outsider mentality and relentless drive. As he later reflected, his U.S. experience liberated him from Japan’s conservative norms.

Founding Soft Bank: From Software to Empire

In 1981, at age 24, Son founded Soft Bank as a software distributor and publisher of computer magazines. The name “Soft Bank” symbolised “banks of software”—a vision of software as essential infrastructure, like financial banking. Starting with $10,000 borrowed from his father, Soft Bank grew rapidly amid Japan’s PC boom.

By the mid-1990s, Son pivoted to internet investments. He acquired stakes in Yahoo! Japan (1996), establishing it as a dominant portal, and launched Yahoo! Broadband. Soft Bank went public in 1994, but the dot-com crash in 2000 wiped out $59 billion in value—Son’s net worth plummeted from world’s richest (briefly) to near bankruptcy. Shares collateralise for loans teetered, but he rebounded.

Key milestones:

- Acquired Vodafone Japan’s mobile unit (2006) for $15 billion, rebranding to Soft Bank Mobile.

- Bought 76% of Sprint (2013), merging it with T-Mobile (2020) in a $26 billion deal, yielding Soft Bank a 4.5% Deutsche Telekom stake.

Today, Soft Bank Group is a holding company with telecom (Soft Bank Corp.), e-commerce (Yahoo Japan via Z Holdings), and investments. Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th Century holds ~34% stake.

Soft Bank Corp.’s New Headquarters Inspires Communication …

(Soft Bank headquarters in Tokyo, symbolising the company’s growth from humble offices to a global hub.)

Breakthrough Investments: Alibaba and Global Bets

Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th Century legend solidified with his $20 million investment in Alibaba in 2000—a stake that ballooned to $132 billion by 2018 after Alibaba’s IPO. Soft Bank sold portions gradually, but the return (over 6,000x) funded bolder plays. Jack Ma called Son his “godfather.”

Other successes:

- Arm Holdings: Acquired for $32 billion in 2016; IPO in 2023 valued at $54 billion initially, surging to $200+ billion amid AI chip demand.

- Post-Fukuyama (2011), Son invested in solar energy, criticising nuclear power and planning massive projects in Saudi Arabia (200GW) and India (100GW renewable by 2027).

These bets showcased Son’s “300-year vision”—long-term horizons others ignore.

The Vision Fund Era: Ambition and Turbulence

In 2017, Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th Century launched the $100 billion Soft Bank Vision Fund (SVN), backed by Saudi Arabia’s PIG, Abe Habit, Apple, and others, targeting AI, robotics, and tech unicorns. SVN invested in 88 firms: Tuber, We Work, Door Dash, Grab, etc.

SVF2 aimed for $108 billion but scaled down. Highlights:

- We Work: $18.5 billion invested; valuation crashed from $47 billion to near-zero in 2019, costing $14 billion write-down.

- Other flops: One Web bankruptcy, Wyo struggles, Wire card scandal.

FY2022 losses hit $27.4 billion; Son personally owed Soft Bank $5.1 billion. Critics called it a “failed experiment.” Yet, by 2025, SVN rebounded: 727 billion yen ($4.8 billion) profit by March 2025, driven by Arm and Coupling.

Son admitted embarrassment but doubled down: “I stake my life on AI.”

Challenges and Setbacks: Resilience Through Crisis

Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th Century career is punctuated by volatility. Dot-com bust (2000): Lost most wealth, contemplated retirement. We Work debacle (2019): Nearly derailed SVN. COVID-19 exposed portfolio weaknesses; Chinese crackdowns hit Dido, Ant Group.

Personal debt and collateralise shares (over 1/3 of stake) raised alarms during 2023 banking scares. Governance critiques: Impulsive decisions, side deals.

Yet, Son’s phoenix-like recoveries—via Alibaba dividends, T-Mobile merger—cement his reputation.

AI Revolution: Open AI, Stargaze, and AS Vision

2025 marked Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th Century AI renaissance. Soft Bank committed up to $32.2 billion in Open AI ($2.2 billion initial via SVN, $30 billion follow-on April 2025). By December 2025, $41 billion was fully invested, securing 11% stake—history’s largest private tech funding round.

Sold $5.8 billion NVIDIA stake to fund this, despite regrets. Other deals: $5.4 billion for AB Robotics (October 2025), $4 billion Digital Bridge acquisition (December 2025) for data centres.

The crown jewel: Stargaze Project, announced January 22, 2025. A new entity investing $500 billion over four years ($100 billion immediate) in U.S. AI infrastructure. Partners: Soft Bank (financial lead), Open AI (operational), Oracle, MG. Tech allies: Arm, Microsoft, NVIDIA. Son chairs Stargaze LAC.

Goals: 10-gigawatt data centres (starting Texas), job creation (hundreds of thousands), U.S. AI supremacy, re-industrialization. By September 2025, five new sites advanced the timeline.

In his 2025 CEO message,Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th Century envisions Artificial Super Intelligence (AS)—beyond human cognition—as Soft Bank’s future. Arm (325 billion chips shipped) powers this; acquisitions like Graph core, Ampere bolster chip design. Soft Bank aims for “No. 1 AS platform,” deploying “Crystal intelligence” internally by end-2025, partnering Open AI for AI agents.

Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th Centuryepiphany: Seeing a microchip photo in 1975 sparked his 50-year quest. “The moment has come to discuss the future in earnest.”

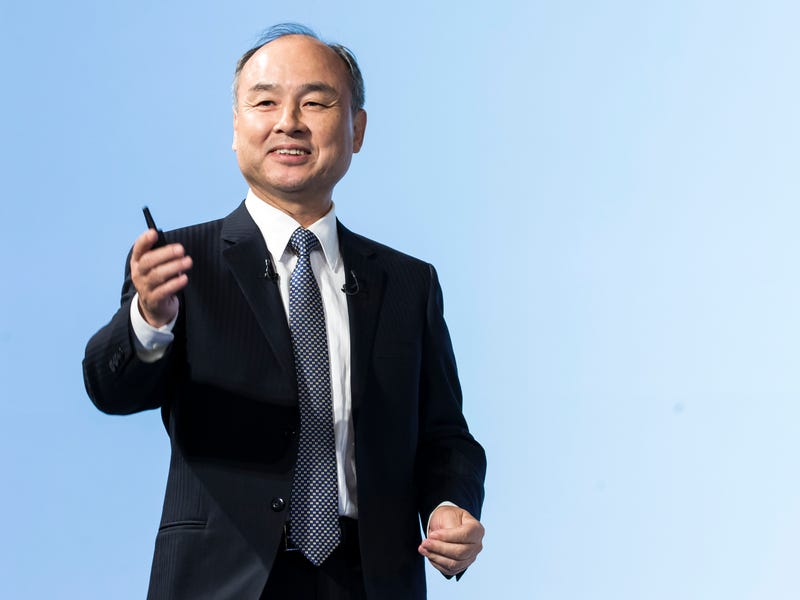

Meet Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th Century , the Billionaire Soft Bank Founder and CEO …

(Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th Century portrait: The visionary investor whose AI bets have redefined his legacy.)

Personal Life and Philanthropy

Married to Masai Ono since 1979 (daughter of a doctor), Son has two daughters. The eldest, possibly Maya Arawakan, has stayed out of spotlight but rumoured business ties emerged in 2025. Family lives in a $85 million Tokyo mansion with indoor golf and a $117 million Wood side, California estate.

Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th Centuryowns Fukuoka Soft Bank Hawks baseball team. A Burgundy wine aficionado (favourites: La Touche), he credits U.S. roots for openness.

Philanthropy: Less publicised than investments, but Son supports education, disaster relief (post-Fukuyama solar push aided recovery), and Zucchini Korean youth as a role model. Through Soft Bank, initiatives in renewable energy promote sustainability.

Three brothers: Youngest Tailor founded Bunghole (Puzzle & Dragons) and Mistletoe CC.

Legacy and Future Outlook

Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th Century legacy: Transforming Soft Bank into a $100+ billion empire, democratising tech via Yahoo Japan, empowering startups globally. Ranked TIME’s #1 AI Influence (2024), he’s criticised for hype but praised for foresight—Alibaba alone created millions of jobs.

As Japan grapples with ageing demographics,Masayoshi Son Japan’s Richest Billionaire Via The Best Of Open Ai in 20th CenturyAS push promises economic revival. Risks: AI ethics, bubbles, debt. But with VAN ~¥31 trillion (June 2025), Soft Bank trades at discount, hinting upside.

Son’s mantra: “Succeed or fail spectacularly.” At 68, his 300-year plan endures.

For more: SoftBank Annual Report 2025

Masayoshi Son, the founder and CEO of Soft Bank Group, has once again solidified his status as Japan’s wealthiest individual. As of early 2026, Forbes estimates his net worth at around $58.9 billion, placing him well ahead of competitors such as Uniqlo founder Tadashi Yanai. This resurgence is largely driven by Soft Bank’s aggressive pivot toward artificial intelligence, highlighted by a landmark $41 billion investment in OpenAI and leadership of the ambitious $500 billion Stargate AI infrastructure project.

Masayoshi Son journey is one of extraordinary ambition and risk. Born in 1957 to a Zainichi Korean family in Saga Prefecture, he faced discrimination from a young age. His family’s modest beginnings—his father ran a small bootleg sake business—instilled in him a fierce work ethic. At 16, inspired by stories of success in America, Son moved to California, where he quickly earned a degree from UC Berkeley in economics.

His entrepreneurial spirit emerged early. While still a student, he invented a multilingual electronic translator, which he sold to Sharp for $1.7 million, and started an arcade-game importing business that netted $1.5 million. These early wins gave him the capital and confidence to return to Japan and found Soft Bank in 1981.

Soft Bank began as a small software distributor and magazine publisher, capitalizing on Japan’s booming personal computer market. Son’s vision was expansive: he saw software as the future’s “currency,” much like banks handle money. The company grew rapidly, but it was his bold foray into internet investments in the 1990s that set the stage for his future fortune.

In 1996, Soft Bank acquired a stake in Yahoo! Japan, which became the country’s leading portal. More famously, in 2000, Son invested $20 million in a little-known Chinese startup called Alibaba. That investment would later explode in value, peaking at over $132 billion after Alibaba’s IPO, and remains one of the most successful venture bets in history.

The dot-com crash of 2000 nearly wiped Masayoshi Son out. Soft Bank’s market value plummeted, and his personal wealth vanished almost overnight. Yet he refused to give up. He restructured debt, sold assets, and pivoted the company into telecommunications. In 2006, Soft Bank acquired Vodafone Japan for $15 billion, rebranding it as Soft Bank Mobile. The 2013 acquisition of Sprint and its eventual merger with T-Mobile further strengthened the company’s telecom arm.

Perhaps the most transformative chapter came with the launch of the $100 billion Soft Bank Vision Fund in 2017. Backed by Saudi Arabia’s Public Investment Fund, Abu Dhabi’s Mubadala, Apple, and others, the fund invested heavily in AI, robotics, and disruptive startups. Successes included DoorDash, Grab, and Coupang, but the fund also faced major setbacks. The WeWork collapse in 2019 cost billions, and other investments like OneWeb and Oyo struggled. Critics questioned Son’s judgment, but he remained unapologetic, famously stating, “I stake my life on AI.”

By 2025, the tide had turned. Arm Holdings, acquired for $32 billion in 2016, saw its stock surge on AI chip demand, driving massive gains. Soft Bank’s Vision Fund posted strong profits, and the company’s share price rose more than 60% in 2025 alone.

The defining moment of Son’s latest chapter came in 2025 with the announcement of a $41 billion investment in OpenAI. Soft Bank committed $2.2 billion initially and followed with $30 billion more, securing an 11% stake in the company behind ChatGPT. To fund part of this, Son sold a significant NVIDIA stake, a move he later called “painful” but necessary.

Even more ambitious is the Stargate Project, a $500 billion joint venture launched in January 2025. Led by Soft Bank, OpenAI, Oracle, and MGX, Stargate aims to build massive AI data centres across the United States. Son chairs the project, which plans to deploy 10 gigawatts of computing power—enough to power millions of homes—and create hundreds of thousands of jobs. The first phase, starting in Texas, is already underway, with additional sites planned.

Son’s vision extends far beyond infrastructure. He speaks of Artificial Super Intelligence (AS)—machines that surpass human intellect—and positions Soft Bank as the platform to achieve it. Arm’s vast chip ecosystem, combined with acquisitions like Graph core and Ampere, positions the company at the centre of the AI revolution.

Despite his success, Son remains a controversial figure. His aggressive style, massive debt, and high-risk bets draw criticism. Yet his track record is undeniable: from Alibaba’s meteoric rise to Arm’s resurgence, he has repeatedly turned visionary ideas into reality.

At 68, Son shows no sign of slowing down. His “300-year vision” reflects a long-term mindset rare in business. As Japan faces demographic challenges and global competition in technology, Son’s AI push could help re-energise the economy.

From a bullied immigrant child to Japan’s richest person and one of the world’s most influential tech investors, Masayoshi Son’s story is a testament to perseverance, bold thinking, and an unrelenting belief in the future.